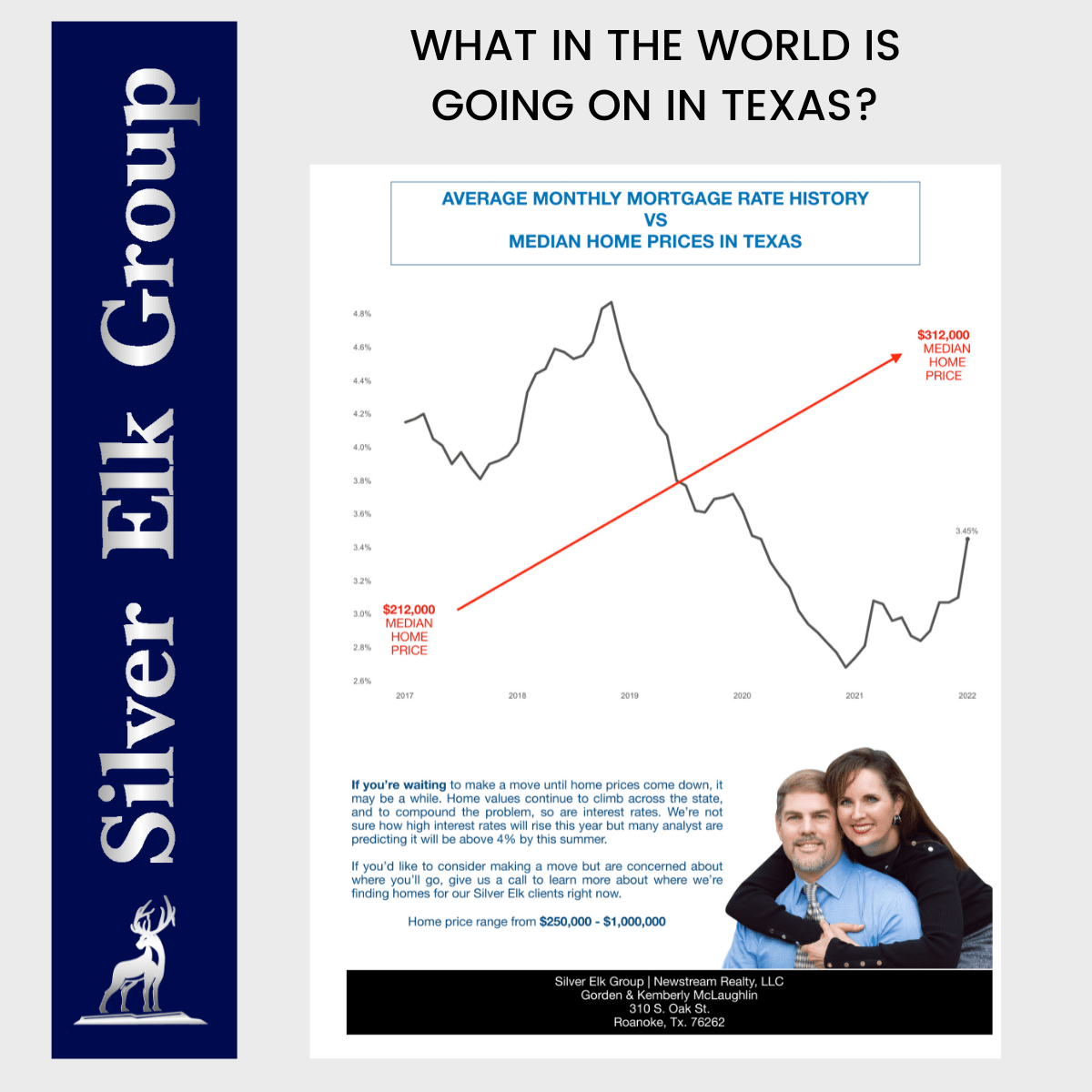

There were no other investment vehicles that grew profit in Texas like real estate in 2020 – 2021. In fact, a single family home in just about any neighborhood, near a major metro area, that was in good shape and not run down, realized appreciation gains of 4% – 20% in the most recent 24 months.

Making large purchases in a rising cost environment doesn’t typically make sense does it? But if you own a piece of Texas real estate, and are thinking about cashing in on above market valuations to reinvest or buy up, now just may be the perfect time. Interest rates are beginning to climb in concert with efforts to slow down inflation, and the cost of that will dramatically impact home buyer affordability over the coming months. At the same time we are seeing historic increases in housing costs which in it of itself makes it difficult for most first time home buyers to compete for available inventory.

However, if you have a home to sell there’s a very strong likelihood that you could cash in big. Even though housing prices have increased, the reinvestment of abnormal gains from the sale of your home could provide you with a rare opportunity to move up, pay off debt or completely change your life style. If making a move has crossed your mind lately it may worth taking a look at. https://www.silverelkrealty.com/quick-estimate/

*Data updated December 2021.